One day, we received an unexpected money transfer from a client and this feedback:

As they say in such cases: what happened? We’ll tell you now!

A company providing accounting and tax services in the United States had everything it needed to succeed: a professional team, expertise, and satisfied clients who kept coming back and recommending them. But there was one problem: new clients were coming in randomly. Most of the requests came from small businesses looking for services at the lowest possible price, and the entire flow of customers was based on word of mouth.

They wanted more. Entering the medium+ segment — companies with an annual turnover of $750,000 to $3,000,000 — required a different approach. These are not clients looking for a “cheap accountant”. These are businesses in the US that need to optimise their tax burden, get strategic financial planning and avoid problems with the IRS. They choose not for price, but for reliability and expertise.

But there is a nuance: these clients did not even know about the company’s existence. They did not find it among competitors.

That’s why we set about doing in-depth market research and creating a marketing strategy that would not only attract leads, but also build trust and position the company as an expert for medium-sized businesses.

| How long did it take to develop the strategy? | 200 hours |

| What is the composition of the marketing strategy development team? | Head of Marketing Team, Head of Content Team, project manager, operational marketer, content marketer, Head of PPC Department, PPC Facebook specialist. |

| How were the results of the work used? | Independent implementation by the client’s team |

We have signed a non-disclosure agreement (NDA), so the client will remain incognito in this case.

How we entered the US market

In financial consulting, each player strives to find its own niche and the right vector of development. However, in a market worth hundreds of billions of dollars and highly competitive, simply saying “we also provide accounting services” is not enough.

Our client is a company that provides solutions in the field of accounting, taxation and business consulting.

Specialisation:

- Accounting, financial reporting and payroll.

- Preparation of tax reports and tax planning.

- Business and financial consulting.

- Business registration.

- International taxation and FBAR.

- Representation in controversial matters before the IRS / states.

Therefore, within the framework of the market analysis, taking into account the specifics of the company, we considered 3 main sectors — taxes, accounting, consulting.

When analysing the market, we dived into the essence of the processes that shape demand and determine the competitive situation.

Accountancy businesses often lack clear communication about their values, technological advantages and expertise. Do you want your clients to choose you? We know how to build marketing that generates trust and growth. Leave a request for a free consultation!

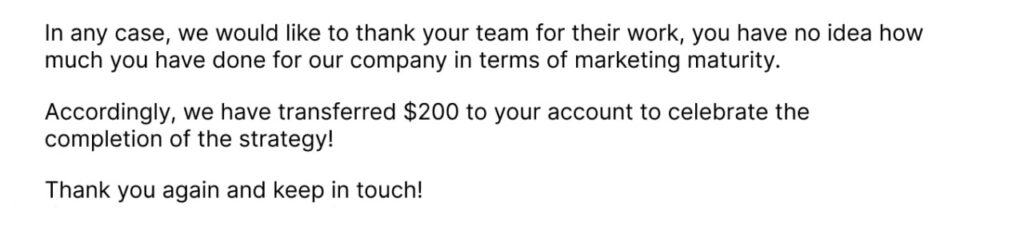

In assessing the size of the market, we found that the US financial services market will reach nearly $116 billion by 2032, with demand for accounting and tax advisory services growing steadily

In the accounting services category:

Market trends: Automation, personalised approach and artificial intelligence are fundamentally changing the accounting and tax consulting industry.

Most companies are not yet ready to adapt to these changes, and clients are already expecting better technical competence from them. Already, 82% of clients expect their accountant to not only keep records, but also understand the technological processes that affect the business.

Machine learning software solutions are being integrated into daily processes, and clients are increasingly relying on digital platforms.

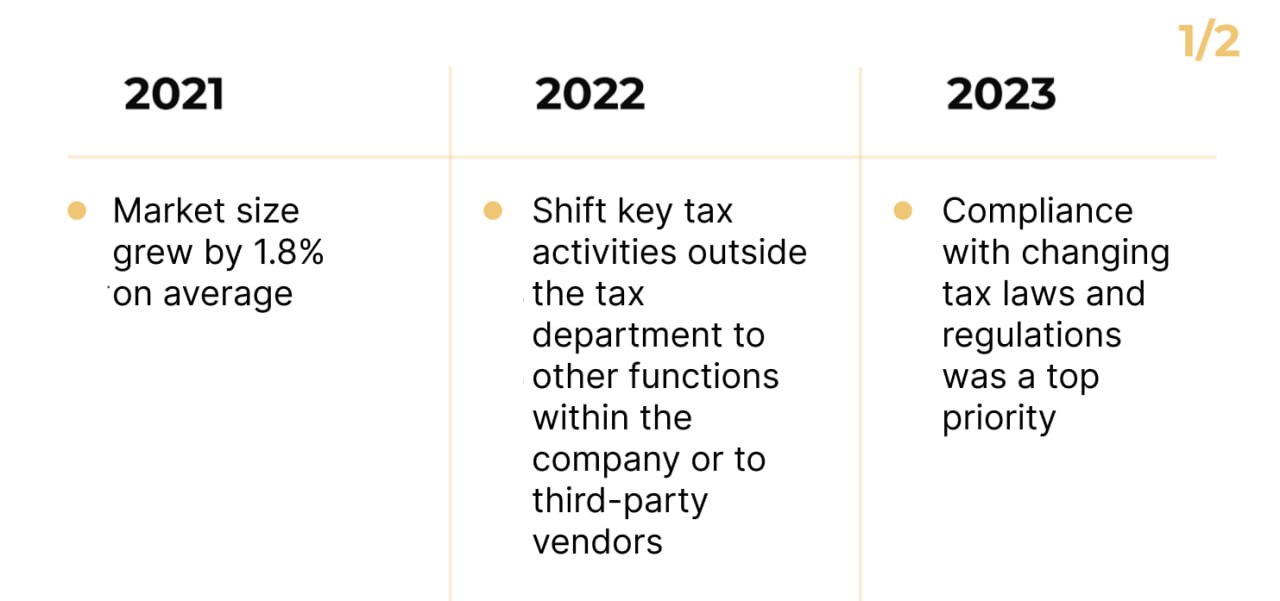

Predicted changes in trends from 2021 to 2026:

We have analysed where the demand for accounting and tax services is highest and found that the key business hubs are New York, California, Florida and Illinois.

But most companies fail to create a clear positioning, build trust, and consider the key factors in client choice.

We have found that clients doubt the qualifications of specialists, are afraid of hidden fees and want more than just accounting — they are looking for a strategic partner to help them make financial decisions. Additional challenges:

- Language barrier for immigrants.

- Challenges in obtaining loans.

- Difficulty in managing financial affairs.

Without in-depth market analysis, understanding of the competitive environment and customer psychology, it will be difficult to reach this level.

In competitive markets with high traffic costs, developing a marketing strategy can save tens of thousands of dollars in advertising budgets that would otherwise be wasted due to incorrectly identified audience needs, lack of positioning, and misunderstanding of choice factors. A marketing strategy allows you to save time and money, clearly outline options that will not work, and identify potentially interesting solutions.

A marketing strategy allows you to save time and money, clearly outline options that will not work, and identify potentially interesting solutions.

The market for accounting and tax services is highly competitive. It includes international giants such as Deloitte, PwC, EY, KPMG, which control 40% of the market, and small CPA companies fighting for their niche.

However, even among the largest players in the classic niches, rapid adaptation to changes is rather an exception. Successful companies will be those that develop their brand, build a strong positioning, and create trust through modern marketing strategies

Competitors are atoms apart

Speaking of the US accounting business, the number of companies and private consultants exceeds two million registered legal entities.

Certified CPAs: 670,00.

Accountants and consultants: 1 400 000.

Tax return preparation companies: 100 000.

Our client wanted to attract medium-sized businesses (annual revenue $750,000+), including immigrants from Ukraine, Kazakhstan, and Moldova. But how to position yourself to be noticeable and not become another CPA who simply competes on price?

We took a comprehensive approach to competitor analysis. We analysed not only those whom the client considered to be competitors, but also researched the market more deeply and this is what we found.

Narrow niche = high competition, but small market

Most CPA and accounting firms in the U.S. target the English-speaking market. There are very few companies clearly focused on serving immigrant-owned businesses.

+ Fewer direct competitors.

– The segment of potential clients is quite limited, and scaling opportunities will be difficult.

So, for the CPA firm to grow, it will need to either expand its audience by entering the English-speaking market or broaden its service offerings for its existing target audience.

We analyzed competitors on two levels and examined:

- How companies targeting immigrants operate.

- How CPAs working in the broader U.S. market promote themselves.

1. Analysis of CPA firms for immigrants:

✔ Competitor 1 — strong in content marketing, but struggles with reputation (reviews mention unprofessionalism).

✔ Competitor 2 — uses Meta Ads for promotion, but has a weak-looking website and lacks structured marketing.

✔ Competitor 3 — focuses on networking and franchising, has a well-developed marketing strategy, but a weak sales department.

We found no CPA firm that combines strong expertise, quality service, and good marketing. This opens an opportunity to take the position of “the CPA firm you can trust,” emphasizing service quality and a personalized approach.

2. Analysis of CPA firms for English-speaking businesses:

✔ Competitor 1 — shows that English-language firms are more tech-savvy, offering automated financial solutions, but they rarely highlight personalized service.

✔ Competitor 2 — relies on offline communities, avoids advertising, but builds local trust.

This analysis led to the conclusion that the promotion strategy should combine two approaches:

- Personalization + trust (like immigrant-focused competitors, but with better service).

- Systematic and tech-driven (like English-speaking CPAs, but without sacrificing personal approach).

We also compared client expectations to what competitors actually offer and discovered the following

Problem

Details

Decision

| CPAs don’t explain their value or communicate the risks | 59% of businesses don’t want to outsource accounting because they think it’s too expensive. Many competitors don’t explain why their services are worth the money. | Clearly communicate about saving time, protecting against fines, and minimizing tax risks. |

| Few people communicate about automation and the use of software | 54% of businesses would like their accountant to use the latest financial technologies, but only a few are talking about it. | Add this message to your communication, because customers want it, and competitors hardly use it. |

| They don’t show industry expertise. | 26% of businesses do not trust outsourced accounting because they believe they do not understand the specifics of their industry. Most competitors indicate the business segments they work with, but do not show case studies. | Create cases, success stories, and testimonials that will validate the CPA’s expertise in specific industries |

The CIS immigrant segment has low competition, but also limited scaling potential. Competitors either sell well but have poor service, or vice versa — high-quality service without effective marketing.

More about channels

The website and social networks are the first points of contact with a potential client. If they do not provide benefits and do not build trust, the client simply closes the tab and goes to competitors. Our task is to make the website and social networks not only inform, but also sell.

🔍 We conducted a comprehensive analysis, where we checked the structure of the site, its usability, compliance with SEO standards, the convenience of the mobile version, as well as the company’s social networks and their effectiveness. And here’s what we found…

The Website was a mess — and it hurt the business

In short: language inconsistency, poor user experience, and missing conversion elements.

Examples:

— The website is entirely in English, but blog articles are in Russian and Ukrainian.

— Layout issues: the site displays incorrectly on laptops, with extra menus appearing; on mobile, important blocks are cut off.

— There are client testimonials, but they lack social proof (no links to client profiles or companies).

The blog has great potential — but it doesn’t drive sales

The blog is a strong aspect of the site. It provides valuable articles and actually attracts organic search traffic.

But there are key issues:

- The blog is bilingual, but the site structure doesn’t support this.

- Articles lack calls to action (CTAs) — people read, then leave.

- There’s no “Case Studies” section to show real business results.

- No search feature for blog content — users struggle to find what they need.

This is a textbook case of missed opportunity from good tools that aren’t structured to work as part of a system.

Next steps

✅ Optimize the website, for example:

- Add strong CTAs (calls to action) on every page.

- Fix the language confusion.

- Add credible testimonials with real names or company links.

✅ Turn the blog into a marketing tool, for example:

- Expand the “Case Studies” section.

- Add a blog search function.

- Introduce lead magnets to convert traffic into inquiries.

✅ Boost social media presence, for example:

- Add a LinkedIn page to engage B2B clients.

- Start a YouTube channel to publish expert content.

Currently, the marketing tools are only partially utilized. There are strong elements, but without a systematic approach, the site and social media channels aren’t reaching their full potential.

We will help you turn your marketing into an effective growth tool.

Who to sell services to

To help the CPA firm attract the right clients, we conducted an in-depth target audience analysis. Understanding how businesses of different sizes make decisions, what matters most to them, and which factors influence their choices allows us to effectively sell services and build long-term relationships.

Main client segments

- Immigrant-owned businesses from post-Soviet countries (excluding Russia and Belarus) — these are business owners who: value support in their native language, appreciate an understanding of international taxation, and seek simple explanations for complex tax issues.

- Local American businesses — companies looking for: efficient accounting solutions., financial planning, expense optimization strategies.

We also divided the audience by income. The key conclusion is that different groups of customers require a different approach.

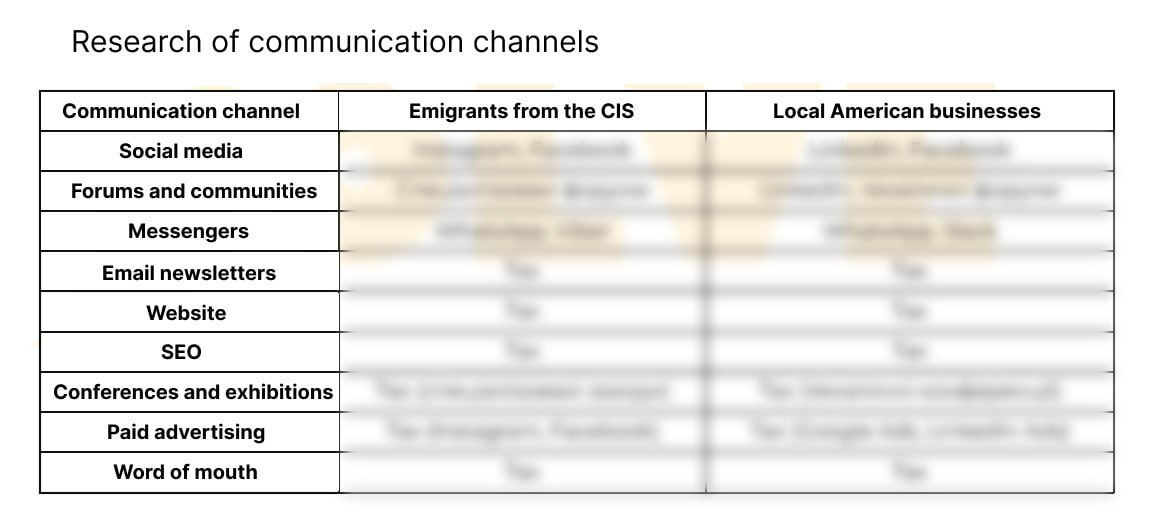

For example: for immigrants from the CIS, personalized communication through social networks and recommendations is important. For local businesses, expert content, a strong LinkedIn and participation in industry events are important.We also explored the psychological profile of each group and researched their preferred communication channels:

This analysis allowed us to create the right positioning for the company — one that is clear and persuasive for each audience segment

SWOT analysis

To gain deeper insight into the company’s current state and future potential, we conducted a SWOT analysis.

This tool helps evaluate internal strengths and weaknesses, as well as external opportunities and threats that could influence operations and growth.

Example — strengths:

- Certified CPA status.

- No language barrier for Russian-speaking clients.

- Broad expertise across multiple niches.

- A wide range of services adapted to the target audience’s needs.

This analysis helps define strategies for scaling the company and attracting more clients — especially from the English-speaking segment of the market

Choice factors — a unique framework

We developed our own approach to analyzing and influencing client decisions — a choice factors framework.

Each client makes a purchase decision based on their own unique set of factors. We’ve identified several key groups of these factors.

Here are some of them:

1. Client awareness of your solution

A client can’t choose your product or service if they don’t even know it exists.

For example, someone unaware of laser vision correction will compare glasses vs. contact lenses.

Your task is to inform the client about your unique way of solving their problem.

2. Positioning and alignment with client expectations

Clients pay attention to how your company presents itself on the market.

Do they see in your positioning, values, and differentiators what truly matters to them?

This factor forms the first impression, often determining the future relationship.

3. Client experience with the company

From first contact to contract signing, the client is evaluating their experience.

Dozens of small factors influence their decision, such as:

- communication convenience;

- response speed;

- quality of materials;

- intuitive processes.

Every detail contributes to an impression — consciously or subconsciously affecting the desire to work with you.

Our task here is to design an ideal experience that inspires clients to choose you.

What separates you from more successful competitors?

It’s often the very choice factors they’ve already implemented — and you haven’t yet.

Our job is to identify these gaps and turn them into your competitive advantage.

We conducted an in-depth study and compiled a list of 150+ factors that influence decisions in accounting and tax services.

Based on that, we created clear business development tasks.

Read more about the choice factors framework here.

Positioning

Almost all CPA firms have built their messaging around a few key ideas:

- We help reduce taxes.

- Comprehensive service: accounting, taxes, legal support.

- Specialization in specific types of businesses.

- Focus on a particular region.

On the one hand, these approaches work. On the other — they do not create a competitive advantage and do nothing to help distinguish one firm from another.

We conducted an analysis and found that for most businesses, the following are important:

- Experience and qualifications.

- Speed and ease of communication.

- Transparent pricing.

- Reputation and real reviews.

- Individual approach

This was not new, but it was important to understand which of these factors are reflected in competitors’ positioning and which are not. This is exactly where we found the differentiation point.

Instead of promising “fewer taxes,” “full support,” or “the lowest price,” we proposed becoming a partner to our clients. An accounting firm that understands the business and helps it grow.

Among various concepts we proposed, the client chose the following:

CPA partner for your growth.

Positioning is the foundation on which a company’s communication is built. A strong brand is not about “we do that too,” but about clearly answering the question “why us?”

We completed a full communications upgrade: website, social media, presentation materials, communication scripts — to convey the essence of the positioning and its impact on clients’ businesses in different ways.

Marketing strategy

The marketing strategy by Solve Marketing is the answer to the question of what exactly needs to be done and how to achieve the planned performance metrics. Based on the research results, the client received a complete guide for developing their marketing. Examples of sections included in the final document:

- Industry event participation plan

- Community and association development plan

- Website update plan

- Google lead generation strategy

- SMM strategy

- LinkedIn growth strategy

- Blog development strategy

- Referral program launch plan

- Client portal implementation plan

- Ratings and awards

What were the client’s impressions? Here’s a glimpse:

And that’s exactly what we got:

And here’s what we got in return:

Celebration budget: $200

The feedback and sense of a job well done — priceless.

Conclusions

This case presents an overview of a project we worked on for two months — and the client referred to it as a “thesis,” studying it for just as long.

What does this case tell us about marketing in general, and marketing for CPA firms in particular?

✅ The accounting services market is changing. Clients expect more from CPA firms than just bookkeeping — they want tech-driven solutions, automation, and strategic financial planning.

✅ Marketing is not just advertising. Strong positioning, trust, content marketing, and personalized communication are key to attracting quality clients.

✅ Word of mouth is great but unreliable. To attract mid-size and larger businesses, you need a marketing system that works independently of personal referrals.

Marketing is not a one-time effort but a systematic process that delivers predictable results

Want an effective marketing strategy that truly brings in clients? Leave a request — and we’ll walk you through how to do it step by step. You’ll be pleasantly surprised by the results, and we’ll be thrilled to receive your feedback!