What is the most important thing for an entrepreneur in running a business? The answer to this question depends on the niche, goals, or stages of development. However, everyone strives for the same thing: to increase profits and optimize costs.

To track and improve performance, there are many different metrics, including the key one for business — LTV. At Solve Marketing, we work with LTV all the time, so now we’re sharing our knowledge, experience, and tips with you.

Customer lifetime value (LTV) — Key aspects

The abbreviation LTV stands for lifetime value, i.e. the lifetime value of a customer. By analyzing this indicator, you will know how much money a customer spends throughout the entire period of interaction with the company.

The most valuable customers are those who most often make repeat purchases with a high average check and remain your regular customers for the longest time. Research shows that retaining regular customers is at least five times cheaper for a company than attracting new ones.

This is possible because:

- You save on advertising. Retaining existing customers requires less advertising costs than finding new ones.

- Regular customers bring more income. If their needs are met, loyalty and trust grow, which contributes to an increase in the average check.

- Servicing regular customers takes less time for managers. They are already familiar with the product, know what they want, and do not need long consultations.

- Regular customers are more likely to recommend you to friends and acquaintances, which allows you to attract more new customers for free.

- Regular customers bring in a stable income, which means that the company has resources to improve business processes and strategic development.

Let us explain what exactly this can affect.

The importance of LTV measurement for business

When you start analyzing your company’s LTV, you will see a way to improve performance in three key areas.

1. Improving customer acquisition and retention strategies

Of course, it would be nice to have unlimited marketing and sales budgets. But even the largest sums spent without strategy and analytics will be as effective as if they were just thrown away.

Many businesses do not evaluate investments in project promotion, do not work on customer retention, and do not calculate LTV at all. As a result, the company suffers from deteriorating customer loyalty, increased marketing costs, loss of competitiveness, negative impact on brand reputation, and limited business development prospects.

LTV is a reliable benchmark that will allow you to reasonably allocate investments in customer acquisition channels and customer retention tools.

For example, if you compare CAC (Customer Acquisition Costs) with LTV, you can determine whether the revenue from one customer exceeds the cost of acquiring them.

2. Ensuring financial stability

If the data obtained from the LTV calculation is entrusted to professionals, the total contribution of one customer to the company’s revenue can reach significant amounts. By analyzing the ratio of expenses to funds received, businesses choose the most profitable strategies. It is enough to work on the identification and development of beneficial customer segments to improve financial performance.

3. Forecasting profitability and market potential

With LTV, you can plan for the long term. The indicator not only shows the current situation, but also allows you to look into the future to make winning decisions now. Businesses use it to forecast future revenue streams, calculate opportunities to increase them, and determine the potential of untapped market segments.

How to calculate LTV: Practical steps

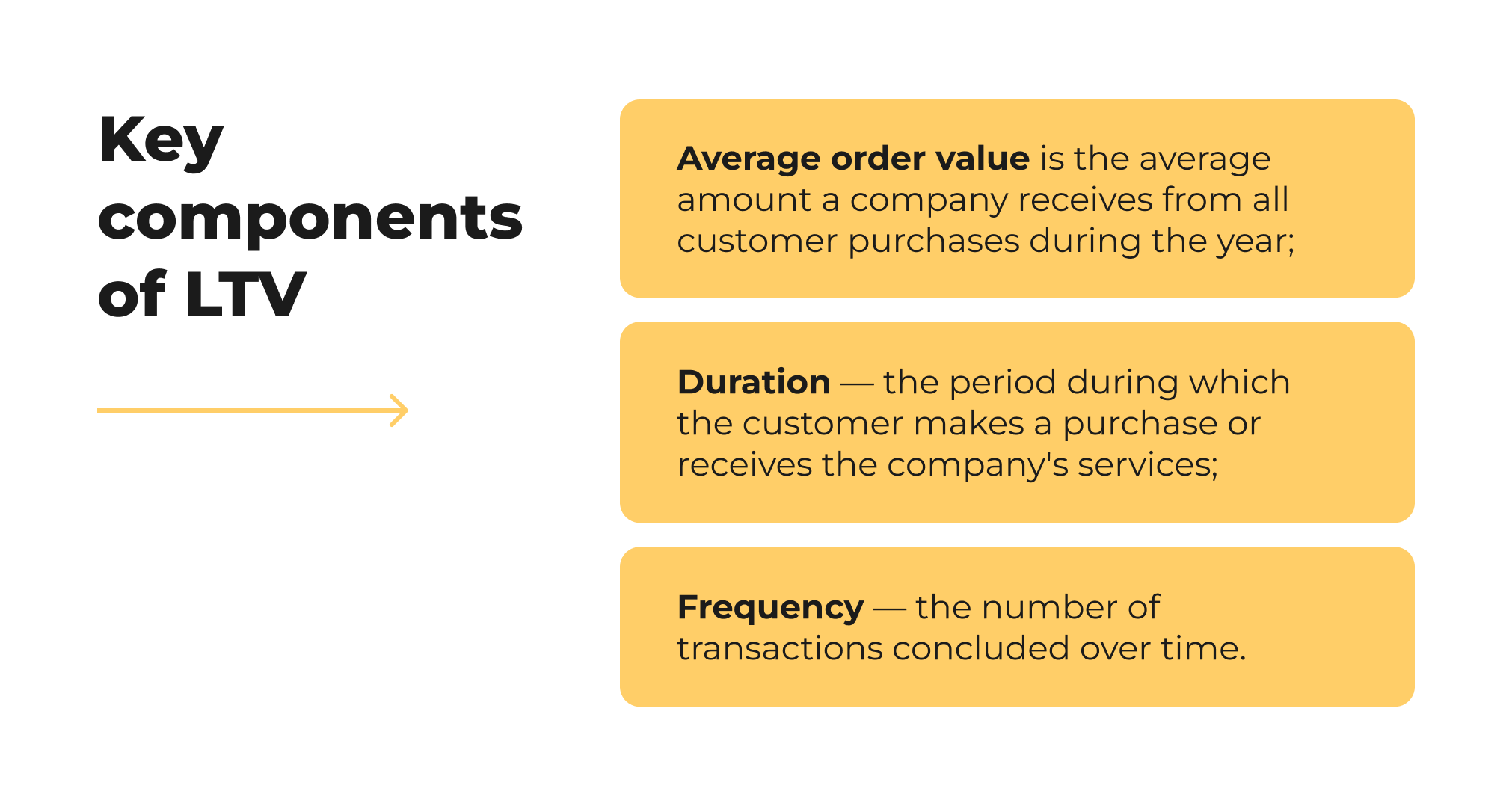

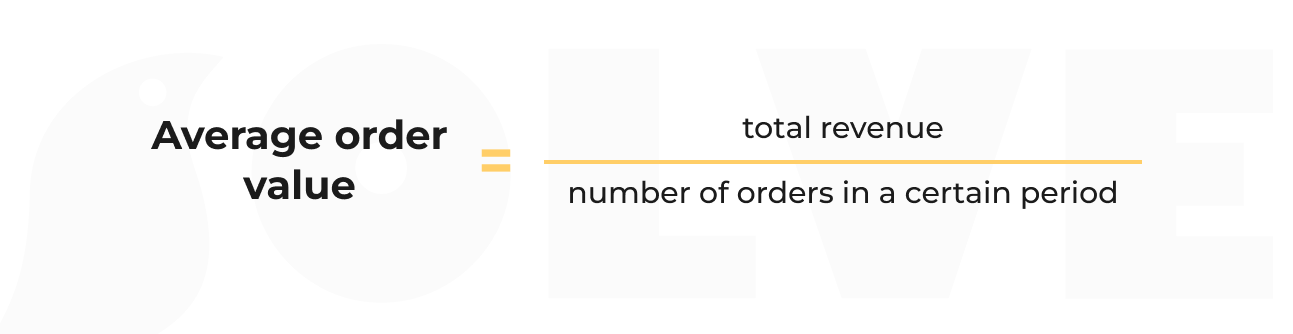

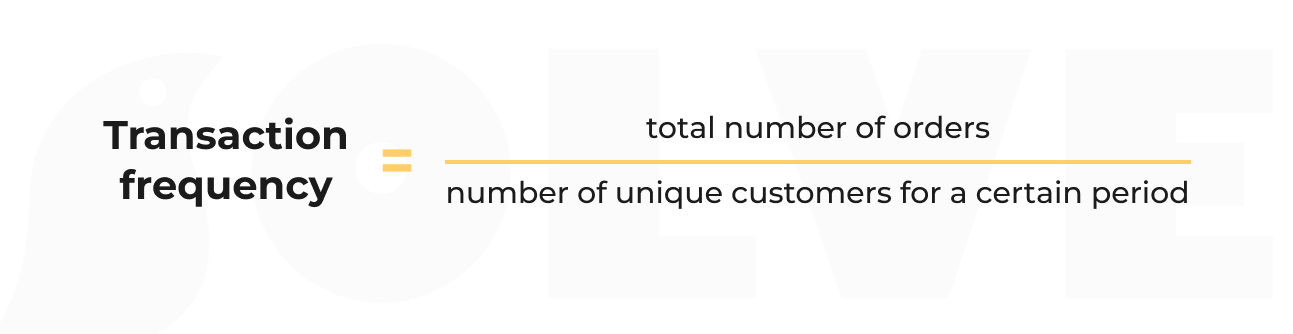

Let’s move on to practice and reveal the secret recipe for calculating LTV. The initial data for the formula are:

These indicators are added to the LTV calculation formula.

LTV = (Average order value) x (Transaction frequency) x (Duration of cooperation)

Let’s use some numbers trying to calculate LTV for a gas station. For example, one customer spends an average of 2000 UAH on one car refueling every 10 days for 2 years. Then the LTV will be as follows:

LTV = (2000 UAH) x (37*) x (2 years) = 148 000 UAH

* 74 transactions = 365 days / 10 = 37

As a result of the calculation, we found that our conditional client can bring 148,000 UAH of profit to the station.

To determine a more accurate LTV, you can and should add other indicators:

— Cost of customer acquisition. CAC is the sum of all acquisition costs divided by the number of attracted customers.

— Gross income. Turnover minus purchase costs.

— Other.

Common mistakes and challenges in determining LTV

1. Poor quality data. The use of incomplete or incorrect data can lead to inaccuracies in the LTV determination. This means that all further work with the results will be useless.

2. Incorrect cost estimation. Some businesses may underestimate all the costs associated with customer retention, including marketing budgets, maintenance costs, etc. And this again leads the business to incorrect calculation results.

3. Neglect of changes. Only calculating LTV and not paying attention to changes in the frequency of purchases, consumer behavior in choosing items for ordering, and checks is a dead-end strategy.

How to increase LTV?

To increase the customer’s lifetime value, you need to work on creating attractive offers and interacting with the audience. We have already emphasized the importance of applying strategies to attract new customers and retain existing ones. Here are some of the ways that have proven to be effective:

Loyalty system

When working with customers, it is important to develop a holistic experience and maintain high engagement to increase customer satisfaction. A loyalty system is a reliable tool that we recommend implementing in your business strategy. It is essentially a means of turning your target audience into regular customers. Effective motivation to make repeat purchases will provide the company with a steady stream of income.

Email marketing

If you suddenly thought that no one reads email anymore, you are wrong. Email marketing remains an effective way to attract and retain customers. According to the research, email communication provides an ROI of $36 for every $1 spent. This figure is higher than any other channel.

In addition to expanding consumer knowledge about a business’s product or delivering news, you can encourage customers to make purchases, return them to abandoned carts, send unique offers, and even surveys. And that’s not all the possibilities of email marketing.

Other ways to increase LTV:

— Create and promote expert content.

— Send newsletters on social media.

— Use tools such as chatbots and push notifications.

— Do not forget to send notifications after the customer makes a purchase.

— Consider a subscription model for the company’s product.

— Make cross-selling and up-selling (combine popular products, offer a discount such as “1+1 = 3”, etc.).— Personalize your marketing. Analyze customer behavior and preferences and create personalized offers for them.

— Ensure high quality not only of your product or service, but also of the maintenance.

As experienced professionals, we can assure you that a strategic approach is the key to success in this business. But entrepreneurs don’t have to dive deep into LTV enhancement techniques. They don’t even need to keep a staff of marketers and analysts for this purpose. They can simply turn to Solve Marketing. As a remote marketing department, we can not only get you a flow of new customers, but also implement a strategy for their further retention and increase of LTV. All you need to do is fill out the form and start fruitful cooperation.

What’s the result?

The LTV indicator has gained immense popularity, becoming an effective indicator of financial success. Evaluation of results in the form of real money makes strategies based on this indicator very profitable for companies. Focusing on the most beneficial segments not only reduces risks but also effectively optimizes the marketing budget.